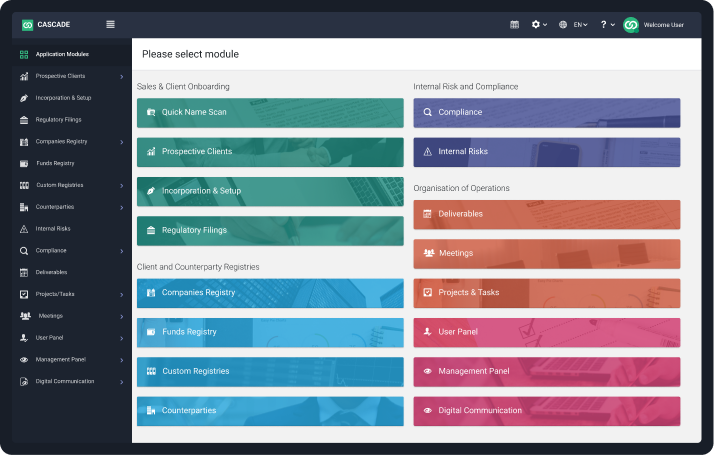

Cascade the Leading End-to-End AML KYC Software

Cascade centralises client data, automates risk-based approach, and keeps you audit-ready every step of the way. From client onboarding to ongoing monitoring, AML/KYC compliance has never been this easy and powerful. This is why Cascade software is recognised by Top Fincrimetech 50 and Top 100 RegTech awards.

Compliance Without the Confusion

Cascade was designed specifically for businesses that don’t have large compliance teams or deep AML expertise. Cascade translates complex regulatory requirements into simple, guided workflows that help you do the right thing — every time. With Cascade, you don’t need to become an AML expert. The platform supports you step by step.

Built for Law Firms, Accountants & Real Estate Professionals

Cascade is trusted by professional services firms who need:

- Clear guidance, not technical jargon

- Software that fits into existing workflows

- Confidence they’re meeting regulatory expectations

- Whether you’re a small practice or a growing national firm, Cascade scales with your compliance needs.

Key Features

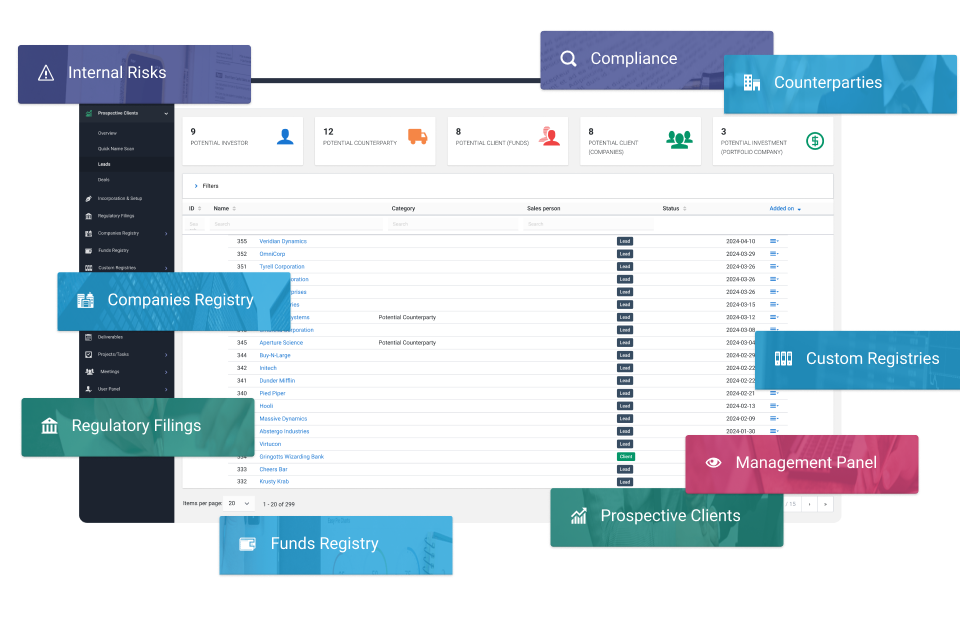

Cascade delivers powerful AML/KYC capability in a platform that is simple to use, easy to understand, and purpose-built for Tranche 2 entities.

Every feature supports a fully customisable, well-structured Risk Based Approach, aligned to Australian regulatory expectations — without unnecessary complexity.

Client Onboarding & Acceptance

Make compliant onboarding simple and consistent from day one.

Digital Onboarding – guided, paperless onboarding workflows

Client Acceptance – structured decision-making before engagement

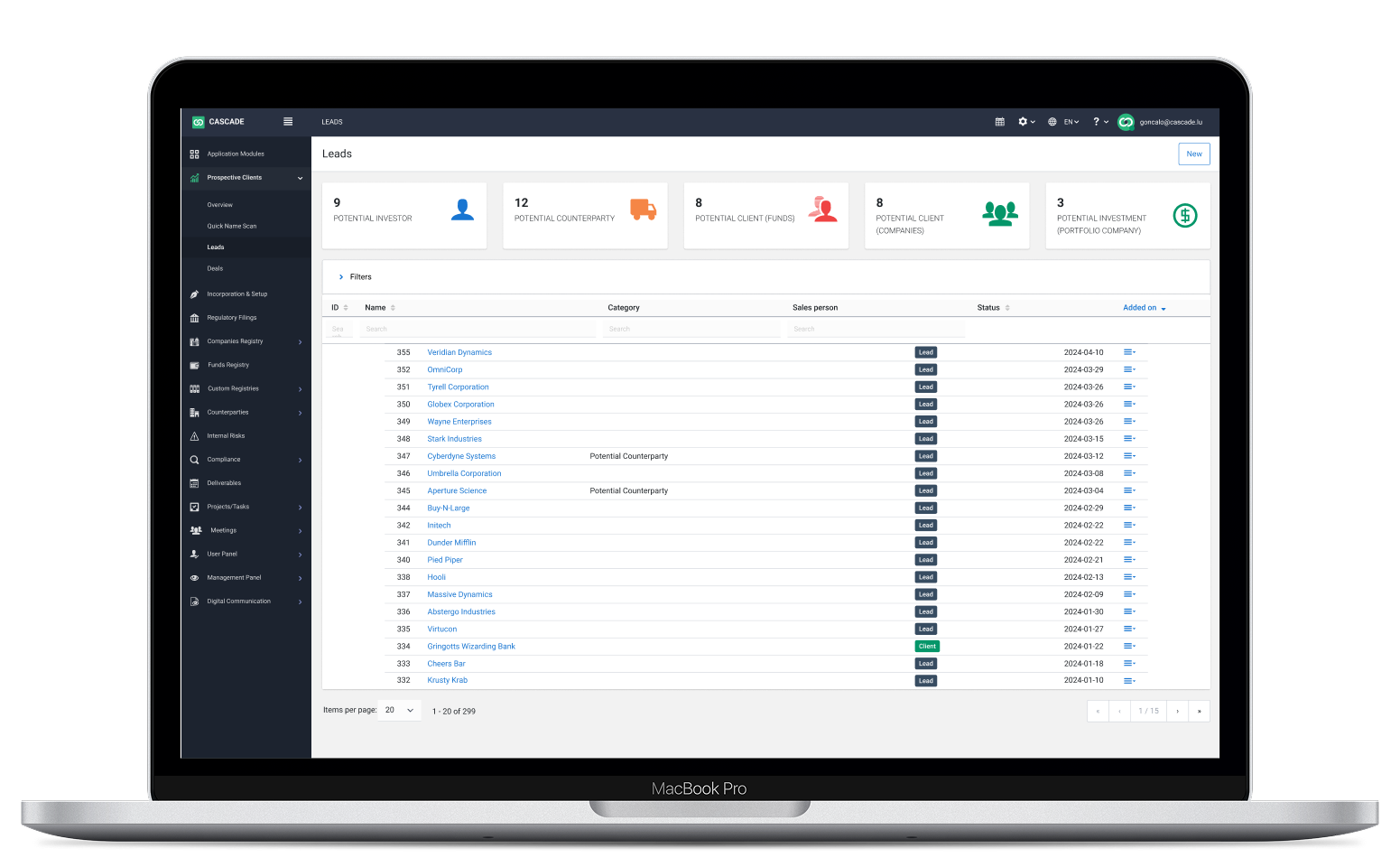

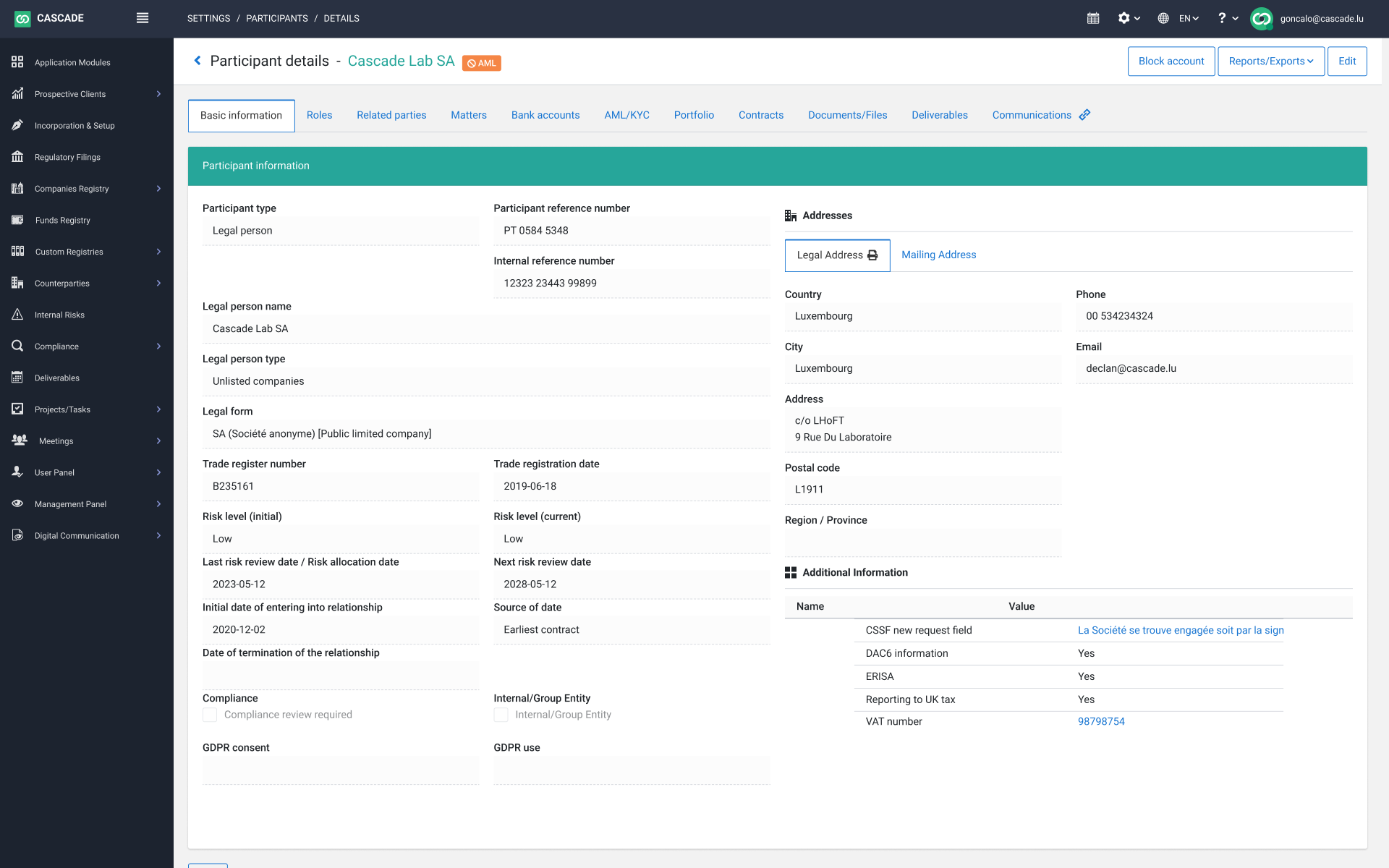

Digital Client Registry – a secure, centralised register of all clients

Collection of Identification Documents – capture and store required KYC documents in one place

Beneficial Ownership Analysis – identify and assess controlling persons

Ongoing Monitoring & Perpetual KYC

Tranche 2 compliance doesn’t end at onboarding.

Cascade supports continuous compliance through:

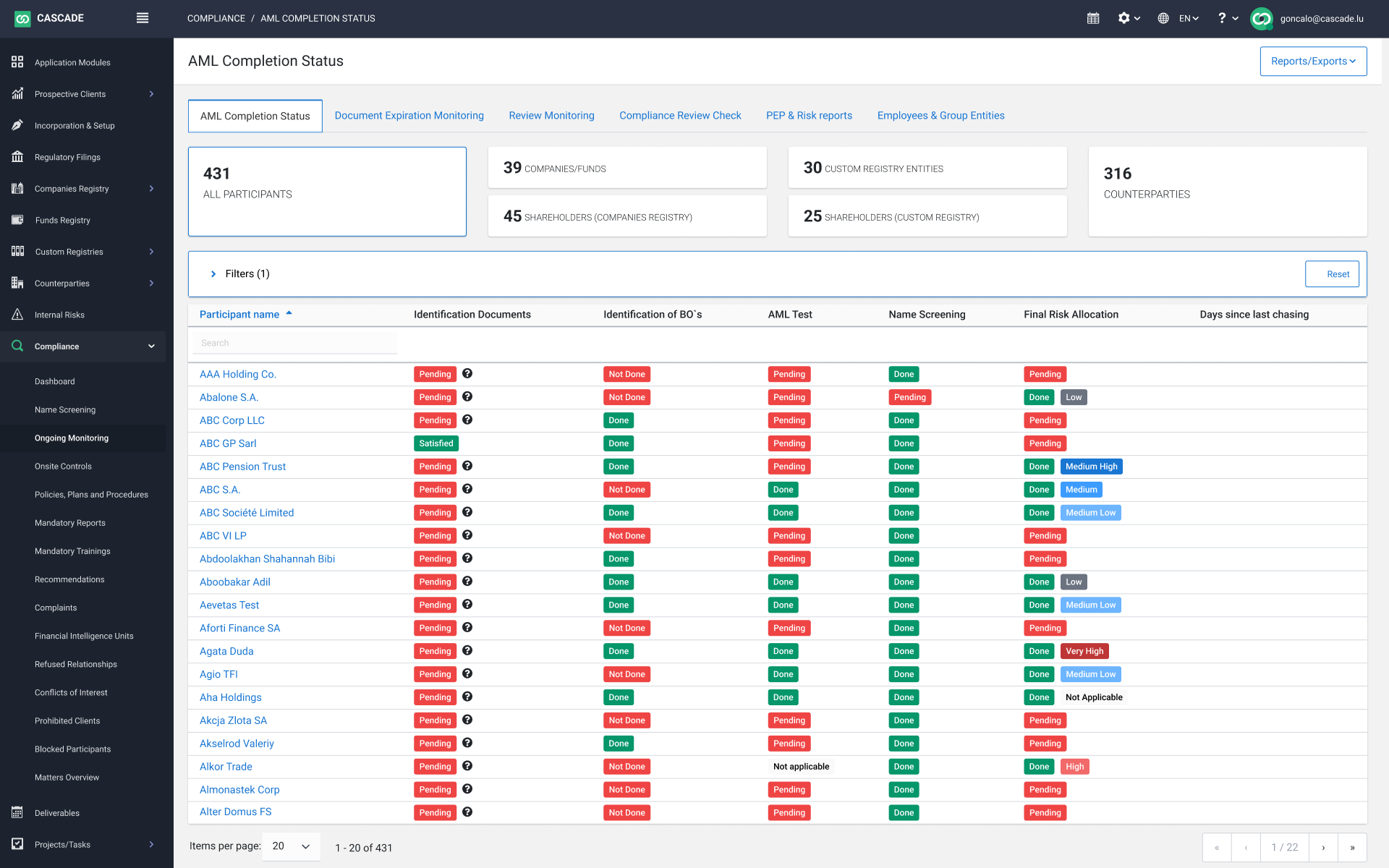

Perpetual KYC – ongoing monitoring of client risk over time

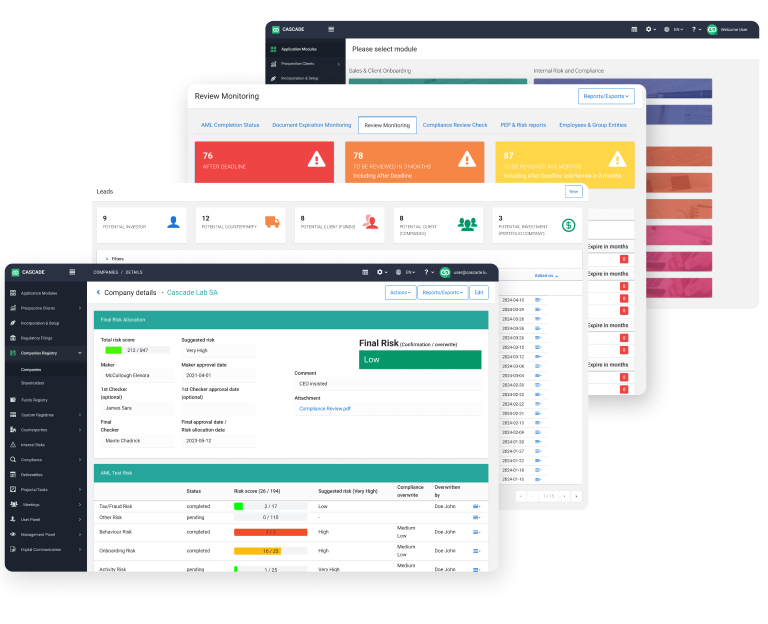

Expiration & Review Monitoring – automated reminders for reviews and expiring documents

Live View of Each Client File – complete visibility of compliance status at any time

Complete Risk Based Approach (RBA)

Cascade embeds a clear, defensible risk-based approach across your entire compliance process.

AML Questionnaire – capture relevant client and service risk factors

Geographical Risk Assessment – automatically factor jurisdictional risk

Name Screening – screen clients and beneficial owners against relevant lists

Final Risk Allocation – consistent, documented client risk ratings

All risk logic is configurable to reflect your policies, services, and risk appetite.

Monitoring, Reporting & Compliance Oversight

Stay in control and ready for regulatory scrutiny.

Transaction Monitoring – monitor activity against defined risk parameters

Suspicious Transaction Registry – record, track, and manage suspicious matters

Compliance Elements – built-in controls supporting AML/CTF obligations

Every action, update, and decision is logged — creating a clear, regulator-ready audit trail.

One Platform Built for

Tranche 2 Compliance

-

Onboard clients with confidence using structured, compliant workflows that:

Capture required client information

Verify identity and beneficial ownership

Automatically assess AML risk

All aligned to Tranche 2 expectations.

-

Tranche 2 compliance doesn’t end at onboarding.

Cascade supports continuous compliance through:

Perpetual KYC – ongoing monitoring of client risk over time

Expiration & Review Monitoring – automated reminders for reviews and expiring documents

Live View of Each Client File – complete visibility of compliance status at any time

-

Every document, decision, and risk assessment is stored in one secure system — creating a single source of truth for your AML/KYC obligations.

-

Cascade automatically maintains a full audit trail of:

Client identification and verification

Risk assessments and reviews

Decisions and changes over time

So when AUSTRAC comes knocking, you’re ready.